Ī business needs an EIN in order to pay employees and to file business tax returns, as well as to open corporate accounts with financial institutions such as banks, credit unions, and brokerage houses. There are EIN Decoders on the web that can identify in what state the company registered the EIN. An EIN is usually written in form 00-0000000 whereas a Social Security Number is usually written in the form 000-00-0000 in order to differentiate between the two.

#Irs contractor ein look up code#

The provision was first enacted as part of the revision of the Tax Code in 1954. The authority for EINs is derived from (b), requiring taxpayer identification for the purpose of payment of employment taxes. The EIN system was created by the IRS in 1974 by Treasury Decision (TD) 7306, 39 Fed. Unlike a SSN, an EIN is not considered sensitive information and is freely distributed by many businesses by way of publications and the internet. In some cases, such as a sole proprietorship, an SSN may be used as a business Tax ID without applying for a separate EIN, but in order to hire employees or establish business credit, an EIN is required. The EIN serves a similar administrative purpose as a SSN, but for a business entity rather than an individual person. SSNs can be validated as to origin and state/year of issuance. SSNs are considered sensitive information and can be used to perpetrate identity theft, thus they are only shared in limited situations, for example, with employers, government entities, insurance agencies, and banks. It is used by the US government to track your earnings, taxes, and employment, as well as eligibility for certain social benefits after retirement. Comparison to Social Security numbers Ī social security number (SSN) is a nine-digit number assigned to US citizens and permanent residents. For example, an EIN should not be used in tax lien auction or sales, lotteries, or for any other purposes not related to tax administration. These numbers are used for tax administration and must not be used for any other purpose.

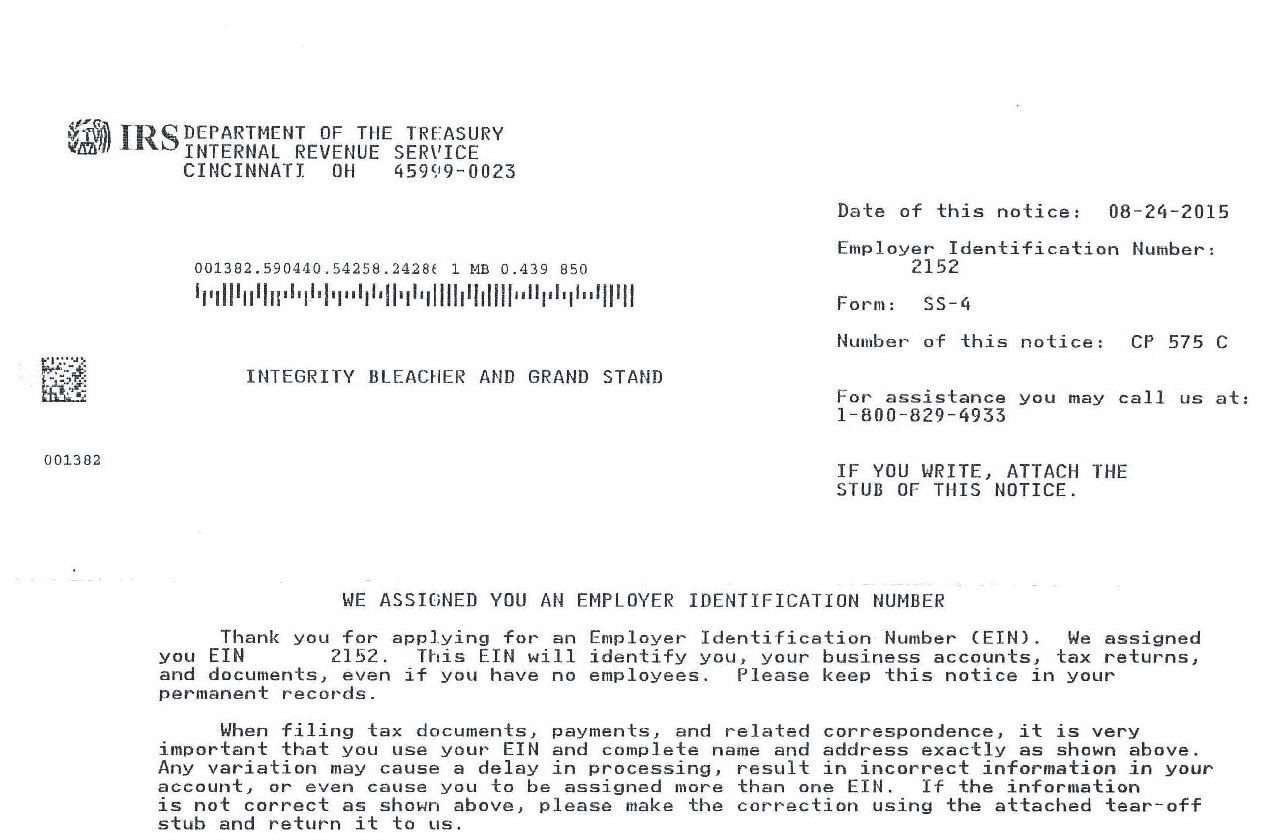

When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. When the number is used for identification rather than employment tax reporting, it is usually referred to as a Taxpayer Identification Number (TIN). The Employer Identification Number ( EIN), also known as the Federal Employer Identification Number ( FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. Use the most comprehensive EIN finder with over 8.5 million records to freely verify or search EIN number for your business partners, contractors etc.Ĭharles River Laboratories International, Inc.Įxpeditors International Of Washington Incįidelity National Information Services, Inc.Internal Revenue Service identification number The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification.

0 kommentar(er)

0 kommentar(er)